PROCESS

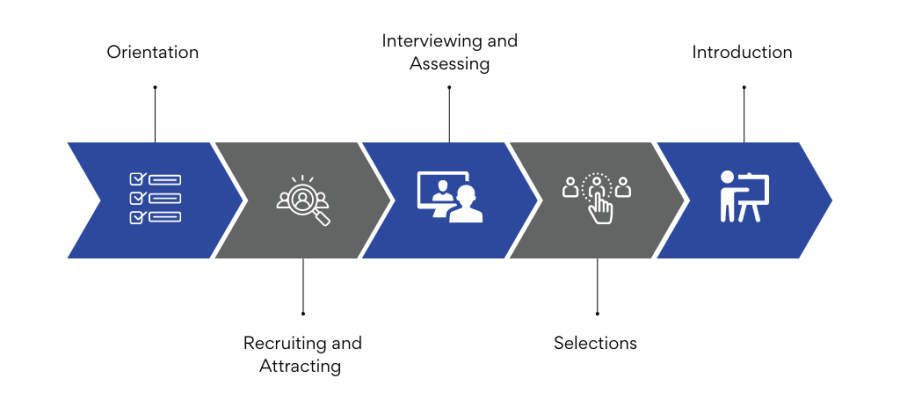

TALENT ACQUISITION PROCESS

Initial Steps

Signing NDA: Ensures confidentiality of sensitive investment information.

Understanding Investment Thesis: Gathers insights about the original investment strategy.

In-depth Analysis

Company Culture & Challenges: Assessing internal dynamics and current hurdles.

PE Firm Ownership Timeline: Understanding the stage of ownership and exit plans.

Revenue/Ebitda Goals: Aligning talent acquisition with financial targets for exit.

Candidate Sourcing

Network Utilization: Leverages over 29,000 LinkedIn 1st connections for accessing non-market candidates.

Referral-Based Approach: Gaining candidates through trusted executive networks.

Candidate Assessment

Psychometric Questionnaire: Evaluates candidates’ suitability without direct interviews.

Investor-Operator Perspective: Unique approach developed since 2005, focusing on investor returns.

Specialized Expertise: Our in-depth knowledge of the investment world means we can offer a level of expertise that general recruiting services simply cannot match. We understand the intricacies of the financial industry, from regulatory changes to market trends, giving our clients and candidates a significant advantage.

Targeted Matches: By living and breathing the investor’s world, we can make highly targeted and precise matches. We don’t just look at resumes; we understand the cultural fit, soft skills, and industry-specific knowledge that are crucial for success in the financial sector.

Strategic Approach: We take a strategic approach to recruitment. Rather than filling positions hastily, we work closely with our clients to understand their long-term goals, helping them build teams that can drive sustained success in the investment world.

Personalized Service: Our tailored recruitment strategies are designed to meet the unique needs and aspirations of each client and candidate. We provide personalized attention, guidance, and support throughout the entire recruitment process.