Case Study: Navigating Private Equity Landscape as an Executive

Case Study: Navigating Private Equity Landscape as an Executive

Written By: Gerald O’Dwyer III

The PE Guru — Blackmore Partners, Inc | April 29th, 2024

EXECUTIVE SUMMARY

This case study explores the strategic journey of an executive navigating the complexities of acquiring and integrating a lower-middle market company through private equity (PE). It encompasses the preparatory phase, including the selection of a comprehensive team of advisors and consultants, and extends through the operational phase to the exit strategy. Highlighting the financial and strategic considerations, this case study aims to provide a blueprint for executives, regardless of their starting point, within the private equity ecosystem.

Executives considering entering or expanding their footprint in the private equity space come from diverse backgrounds, including those curious about PE, working in public or private companies, looking to exit a PE-owned company, seeking more traction within PE, with successful PE exits, or owners of companies in the $25M-$200M range. This case illustrates the journey from the perspective of an executive exploring the acquisition of a lower-middle market company.

Initial Considerations

The executive, recognizing the potential of private equity to accelerate growth and value creation, begins by attending a series of industry conferences, such as Blackmore Connects and ACG. These platforms provide invaluable insights into the market, access to a network of advisors, and knowledge of the latest trends and strategies in the private equity space.

Assembling the Advisory Team

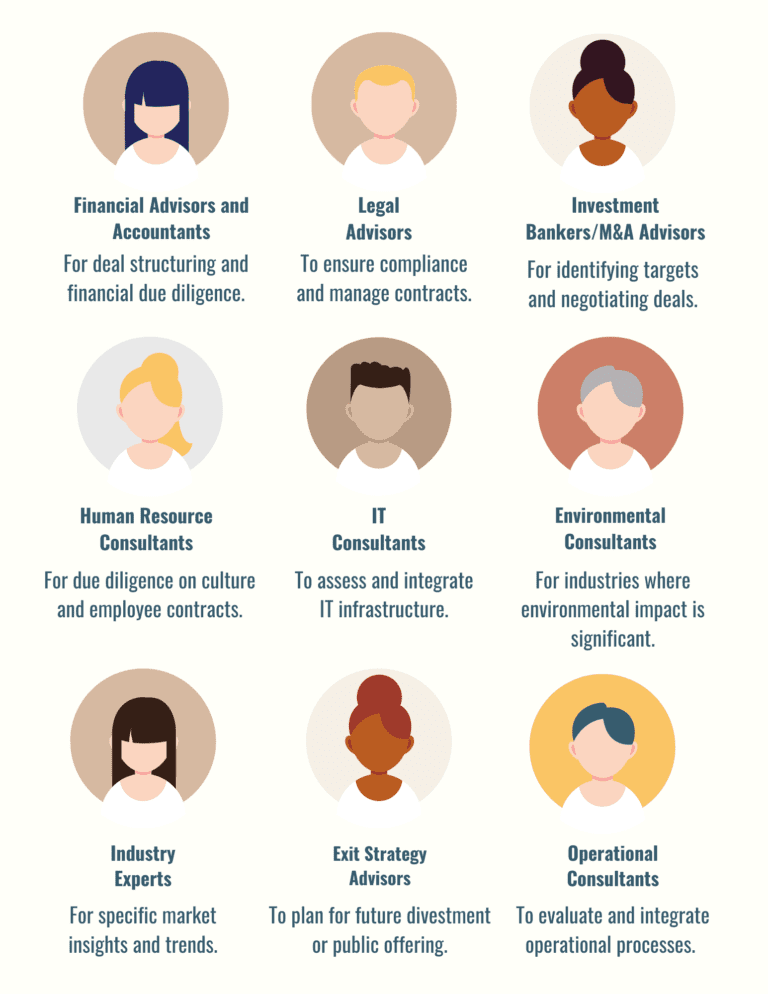

Understanding the critical role of guidance, the executive assembles a multidisciplinary team of advisors, including:

Financial Commitment

The executive commits to a mix of virtual and in-person conferences, investing between $13,000 to $26,000 annually. This investment is deemed strategic, balancing cost with networking opportunities and access to a wealth of resources and potential advisors.

Strategic Benefits

The journey reveals several strategic benefits:

- Access to Advisors and Consultants: Direct connections with industry professionals provide a pathway to successful deals and growth strategies.

- Industry Insights: Understanding market dynamics and operational best practices equips the executive with a competitive edge.

- Peer Learning: Exchanging experiences with peers fosters actionable insights, enhancing operational efficiency and strategic positioning.

- Access to Capital: Networking opportunities with private equity firms and financiers open doors to funding for acquisitions and support for growth initiatives.

Conclusion

For executives embarking on or navigating through the private equity landscape, the strategic investment in building a comprehensive advisory team and leveraging industry conferences offers a significant return on investment. This case study illustrates that success in private equity requires not just financial commitment but a strategic approach to networking, knowledge acquisition, and advisor engagement. Ultimately, the journey from acquisition to exit is enriched by these strategic partnerships, paving the way for enhanced company growth and successful exits in the competitive private equity space.

For more detailed insights on how to effectively navigate the job market as a C-suite executive and leverage opportunities through Blackmore Connects, visit their website here.