It’s essential to have a strong understanding of private equity and demonstrate certain knowledge and skills.

Written by: The PE Guru – Gerald Moran O’Dwyer, III – Blackmore Partners, Inc.

For an executive seeking a role in a private equity-owned company or working closely with private equity firms, it’s essential to have a strong understanding of private equity and demonstrate certain knowledge and skills. Here are some key aspects that an executive should know and demonstrate about private equity:

- Understanding of the private equity model: Executives should have a solid grasp of how private equity firms operate, their investment strategies, and the typical lifecycle of a private equity investment, from acquisition to exit.

- Deal structuring and valuation: Knowledge of deal structuring and valuation methods is crucial. Executives should be familiar with various valuation techniques, such as discounted cash flow (DCF), comparable company analysis, and precedent transaction analysis.

- Due diligence: Executives need to understand the due diligence process, including financial due diligence, legal and regulatory due diligence, and operational due diligence. Demonstrating the ability to lead or contribute to the due diligence process is valuable.

- Growth and value creation: Executives should have a track record of driving growth and creating value in businesses. Private equity firms often look for executives who can identify growth opportunities and operational improvements that can increase the company’s value.

- Alignment with private equity objectives: Demonstrating alignment with the private equity firm’s investment objectives and strategy is essential. Executives should be able to articulate how their skills and experience fit the needs of the portfolio company and align with the firm’s overall investment thesis.

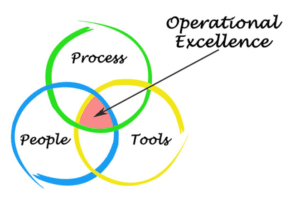

- Operational expertise: Having a deep understanding of the operational aspects of a business is crucial. Executives should be able to identify and implement operational improvements that can enhance the company’s performance.

- Communication and reporting: Executives should be skilled at communicating with private equity investors and providing clear and concise reporting on the company’s performance, growth initiatives, and any challenges faced.

- Exit planning and execution: Understanding the process of exiting a private equity investment is important. Executives should be prepared to participate in exit planning and execution, which may involve an IPO, a sale to a strategic buyer, or a secondary sale to another private equity firm.

- ESG considerations: Awareness of environmental, social, and governance (ESG) factors is increasingly important to private equity firms. Executives should understand the impact of ESG issues on the company’s performance and be able to address ESG concerns.

- Relationship management: Building strong relationships with private equity investors, board members, and other stakeholders is vital. Executives should be able to collaborate effectively with all parties involved in the private equity ownership structure.

Having a well-rounded knowledge of private equity and the ability to demonstrate these skills can make an executive an attractive candidate for roles within private equity-owned companies or for partnering with private equity firms in various capacities.